Tax Rate Dividend Us . Learn how and why certain dividends are taxed more. Dividends are a great way to earn extra income, but you will pay taxes on them. Use marketbeat's free dividend tax calculator to calculate your tax burden. the tax rate for dividends depends on whether they are qualified or nonqualified. how much tax will you owe on your dividend income? dividend tax rate for 2023 and 2024. Here's a breakdown of the. find the latest dividend tax rates and policies, from corporate dividends to stocks to etfs. Qualified dividends, which include those paid by u.s. qualified dividends are taxed at 0%, 15% or 20% depending on taxable income and filing status. Nonqualified dividends are taxed as. You pay tax as a percentage of. see current federal tax brackets and rates based on your income and filing status. the qualified dividend tax rate increases to 20% if your taxable income exceeds $276,925 (married filing separately), $492,300 (single),.

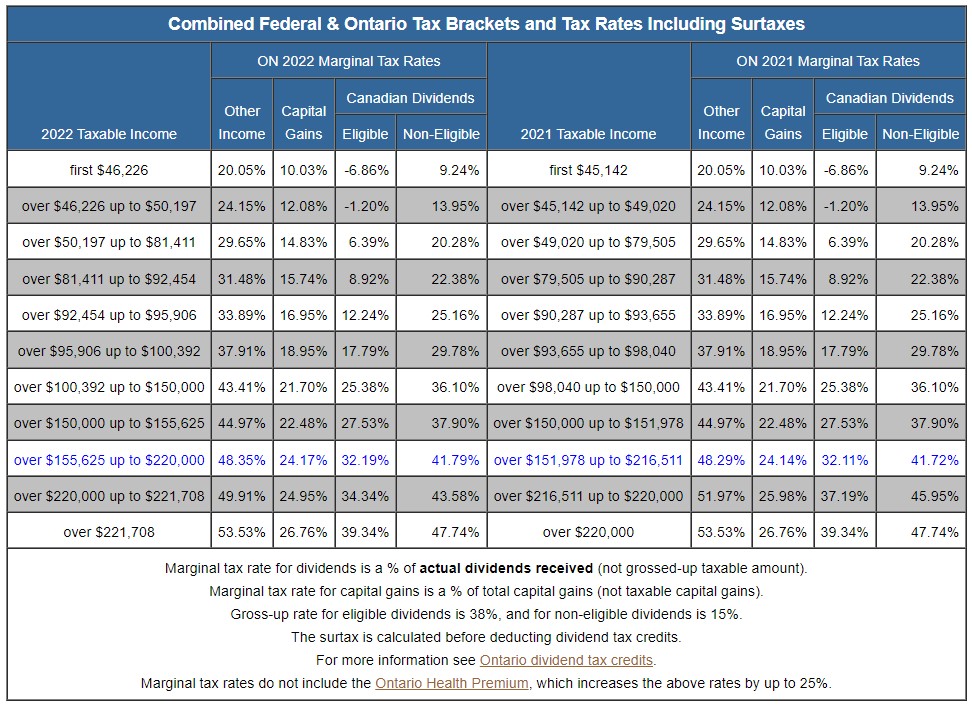

from dividendstrategy.ca

how much tax will you owe on your dividend income? find the latest dividend tax rates and policies, from corporate dividends to stocks to etfs. Nonqualified dividends are taxed as. Learn how and why certain dividends are taxed more. see current federal tax brackets and rates based on your income and filing status. Dividends are a great way to earn extra income, but you will pay taxes on them. dividend tax rate for 2023 and 2024. qualified dividends are taxed at 0%, 15% or 20% depending on taxable income and filing status. Qualified dividends, which include those paid by u.s. the tax rate for dividends depends on whether they are qualified or nonqualified.

Tax efficient DividendStrategy.ca

Tax Rate Dividend Us qualified dividends are taxed at 0%, 15% or 20% depending on taxable income and filing status. the tax rate for dividends depends on whether they are qualified or nonqualified. find the latest dividend tax rates and policies, from corporate dividends to stocks to etfs. Use marketbeat's free dividend tax calculator to calculate your tax burden. Here's a breakdown of the. how much tax will you owe on your dividend income? Dividends are a great way to earn extra income, but you will pay taxes on them. dividend tax rate for 2023 and 2024. You pay tax as a percentage of. Learn how and why certain dividends are taxed more. Qualified dividends, which include those paid by u.s. qualified dividends are taxed at 0%, 15% or 20% depending on taxable income and filing status. the qualified dividend tax rate increases to 20% if your taxable income exceeds $276,925 (married filing separately), $492,300 (single),. see current federal tax brackets and rates based on your income and filing status. Nonqualified dividends are taxed as.

From www.taxpolicycenter.org

T220230 Tax Benefit of the Preferential Rates on LongTerm Capital Gains and Qualified Tax Rate Dividend Us qualified dividends are taxed at 0%, 15% or 20% depending on taxable income and filing status. Use marketbeat's free dividend tax calculator to calculate your tax burden. Nonqualified dividends are taxed as. Dividends are a great way to earn extra income, but you will pay taxes on them. the qualified dividend tax rate increases to 20% if your. Tax Rate Dividend Us.

From www.forbes.com

Best States, Worst States For Dividend Lovers Tax Rate Dividend Us Here's a breakdown of the. Qualified dividends, which include those paid by u.s. qualified dividends are taxed at 0%, 15% or 20% depending on taxable income and filing status. find the latest dividend tax rates and policies, from corporate dividends to stocks to etfs. the tax rate for dividends depends on whether they are qualified or nonqualified.. Tax Rate Dividend Us.

From treatbeyond2.bitbucket.io

How To Avoid Short Term Capital Gains Treatbeyond2 Tax Rate Dividend Us Here's a breakdown of the. Nonqualified dividends are taxed as. qualified dividends are taxed at 0%, 15% or 20% depending on taxable income and filing status. You pay tax as a percentage of. how much tax will you owe on your dividend income? Learn how and why certain dividends are taxed more. Qualified dividends, which include those paid. Tax Rate Dividend Us.

From yourdreaminfo.blogspot.com

Capital gains tax in the United States Tax Rate Dividend Us Learn how and why certain dividends are taxed more. Dividends are a great way to earn extra income, but you will pay taxes on them. see current federal tax brackets and rates based on your income and filing status. Use marketbeat's free dividend tax calculator to calculate your tax burden. Qualified dividends, which include those paid by u.s. You. Tax Rate Dividend Us.

From www.wellersaccountants.co.uk

Beware! Your dividend tax rate is changing, here's what you need to know Tax Rate Dividend Us Qualified dividends, which include those paid by u.s. Nonqualified dividends are taxed as. Learn how and why certain dividends are taxed more. the qualified dividend tax rate increases to 20% if your taxable income exceeds $276,925 (married filing separately), $492,300 (single),. Dividends are a great way to earn extra income, but you will pay taxes on them. dividend. Tax Rate Dividend Us.

From dividendstrategy.ca

Tax efficient DividendStrategy.ca Tax Rate Dividend Us how much tax will you owe on your dividend income? Learn how and why certain dividends are taxed more. Nonqualified dividends are taxed as. the qualified dividend tax rate increases to 20% if your taxable income exceeds $276,925 (married filing separately), $492,300 (single),. Use marketbeat's free dividend tax calculator to calculate your tax burden. the tax rate. Tax Rate Dividend Us.

From www.richardcyoung.com

How High are Tax Rates in Your State? Tax Rate Dividend Us how much tax will you owe on your dividend income? dividend tax rate for 2023 and 2024. Here's a breakdown of the. the tax rate for dividends depends on whether they are qualified or nonqualified. You pay tax as a percentage of. Learn how and why certain dividends are taxed more. Use marketbeat's free dividend tax calculator. Tax Rate Dividend Us.

From www.pdfprof.com

dividend withholding tax rates by country 2019 Tax Rate Dividend Us how much tax will you owe on your dividend income? the qualified dividend tax rate increases to 20% if your taxable income exceeds $276,925 (married filing separately), $492,300 (single),. Qualified dividends, which include those paid by u.s. find the latest dividend tax rates and policies, from corporate dividends to stocks to etfs. the tax rate for. Tax Rate Dividend Us.

From topforeignstocks.com

Dividend Withholding Tax Rates by Country for 2023 Tax Rate Dividend Us find the latest dividend tax rates and policies, from corporate dividends to stocks to etfs. Nonqualified dividends are taxed as. Dividends are a great way to earn extra income, but you will pay taxes on them. Qualified dividends, which include those paid by u.s. qualified dividends are taxed at 0%, 15% or 20% depending on taxable income and. Tax Rate Dividend Us.

From www.simplysafedividends.com

How Dividend Reinvestments are Taxed Intelligent by Simply Safe Dividends Tax Rate Dividend Us Learn how and why certain dividends are taxed more. qualified dividends are taxed at 0%, 15% or 20% depending on taxable income and filing status. find the latest dividend tax rates and policies, from corporate dividends to stocks to etfs. You pay tax as a percentage of. how much tax will you owe on your dividend income?. Tax Rate Dividend Us.

From topforeignstocks.com

Dividend Withholding Tax Rates By Country 2015 Tax Rate Dividend Us Use marketbeat's free dividend tax calculator to calculate your tax burden. the qualified dividend tax rate increases to 20% if your taxable income exceeds $276,925 (married filing separately), $492,300 (single),. how much tax will you owe on your dividend income? see current federal tax brackets and rates based on your income and filing status. qualified dividends. Tax Rate Dividend Us.

From www.moneysense.ca

How much you'll save with the dividend tax credit Tax Rate Dividend Us Dividends are a great way to earn extra income, but you will pay taxes on them. Here's a breakdown of the. see current federal tax brackets and rates based on your income and filing status. the tax rate for dividends depends on whether they are qualified or nonqualified. Learn how and why certain dividends are taxed more. Nonqualified. Tax Rate Dividend Us.

From www.forbes.com

This Dividend Strategy May Save You On Next Year's Taxes Tax Rate Dividend Us Qualified dividends, which include those paid by u.s. Here's a breakdown of the. see current federal tax brackets and rates based on your income and filing status. You pay tax as a percentage of. qualified dividends are taxed at 0%, 15% or 20% depending on taxable income and filing status. the tax rate for dividends depends on. Tax Rate Dividend Us.

From www.marketbeat.com

Dividend Tax Calculator Understanding Dividend Tax Rates Tax Rate Dividend Us Dividends are a great way to earn extra income, but you will pay taxes on them. how much tax will you owe on your dividend income? see current federal tax brackets and rates based on your income and filing status. find the latest dividend tax rates and policies, from corporate dividends to stocks to etfs. the. Tax Rate Dividend Us.

From topforeignstocks.com

Dividend Tax Rate and LongTerm Capital Gains Tax Rate U.S vs.Other Countries Tax Rate Dividend Us Qualified dividends, which include those paid by u.s. the tax rate for dividends depends on whether they are qualified or nonqualified. the qualified dividend tax rate increases to 20% if your taxable income exceeds $276,925 (married filing separately), $492,300 (single),. how much tax will you owe on your dividend income? Dividends are a great way to earn. Tax Rate Dividend Us.

From www.dividenddiplomats.com

The Power of 50,000 in Dividend Explained Tax Rate Dividend Us Qualified dividends, which include those paid by u.s. qualified dividends are taxed at 0%, 15% or 20% depending on taxable income and filing status. how much tax will you owe on your dividend income? Dividends are a great way to earn extra income, but you will pay taxes on them. You pay tax as a percentage of. Learn. Tax Rate Dividend Us.

From topforeignstocks.com

International Dividend Tax Rates Comparison Where Does The US Stand? Tax Rate Dividend Us Here's a breakdown of the. Qualified dividends, which include those paid by u.s. see current federal tax brackets and rates based on your income and filing status. You pay tax as a percentage of. how much tax will you owe on your dividend income? Dividends are a great way to earn extra income, but you will pay taxes. Tax Rate Dividend Us.

From breakingdownfinance.com

Effective Dividend Tax Rate Breaking Down Finance Tax Rate Dividend Us dividend tax rate for 2023 and 2024. Nonqualified dividends are taxed as. the tax rate for dividends depends on whether they are qualified or nonqualified. Use marketbeat's free dividend tax calculator to calculate your tax burden. see current federal tax brackets and rates based on your income and filing status. qualified dividends are taxed at 0%,. Tax Rate Dividend Us.